Financial Literacy Initiative undertaken by Pension Fund Regulatory and Development Authority of India (PFRDA)

PFRDA has launched a dedicated website called “Pension Sanchay” in 2018. Through this website, PFRDA aims towards addressing the need of financial literacy from the perspective of retirement planning. The content of the website has been designed keeping into view the four most important concepts in financial decision making- knowledge of interest rates, interest compounding, inflation and risk diversification. The website has separate blog segment where blogs written by the professionals in the financial sectors and the officers of the Authority are made available which provides meaningful insight regarding the fundamentals of finance, banking and investments.

PFRDA conducts subscriber awareness programs through its central record keeping agencies at different places across India. Further, PFRDA also has empaneled a dedicated training agency for creating subscriber awareness and capacity building regarding the NPS and APY. In addition to the above, PFRDA also conducts Annuity Literacy Program in co-ordination with NPS Trust and Annuity Service Providers for making subscribers aware about the different annuities available to them.

Important Links:

National Pension System NPS Car

National Pension System NPS-Donation

National Pension System NPS TV Campaign Housewarming

How to register under NPS in online mode

What are the charges under NPS

What are tax benefits on withdrawal from NPS

Tax advantage of NPS Corporate Model An illustration

How to register under NPS in offline mode

How does NPS work

How does an entity register under NPS Corporate Model

Does a company also need to pay if it registers under NPS Corporate Model

What investment options are available to a subscriber of NPS Corporate Model

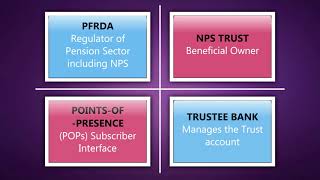

What are the various intermediaries in NPS and what are their responsibilities

What are the types of accounts one gets in NPS

What are the tax benefits of NPS for employees and employers

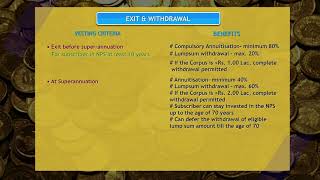

What are the Exit and Withdrawal rules under NPS

Who all are eligible to join NPS

What type of entities are eligible for registration under NPS Corporate Model

What is National Pension System and why do I need it

- Pension Sanchay

- NPS-Corporate Model

- NPS-Subscriber Information for Govt Subscriber

- National Pension System for Corporate

- National Pension System Welcome Kit

- NPS Booklet

- NPS LITE

- Operating Guidelines for PoP(s)/PoP-SP(s)

- Presentation NPS Corporate Model

- FAQ Corporate Sector

- Atal Pension Yojna Scheme Detail Notification

- Atal Pension Yojana

- Atal Pension Yojana (Subscribers' Contribution Chart)

- FAQ ATAL Pension Yojna Hindi English

- FAQ All Citizen