Financial Literacy

Message of the Day

Financial planning is the process of making decisions about money which helps us achieve our goals.

OUR PROGRAMS

What We Do

Financial Education Programme for Adults (FEPA)

The Financial Education Programme for Adults (FEPA) was launched by the NCFE in the month of September 2019. FEPA is a Financial Literacy Programme designed and implemented to spread financial awareness among the adult population such as Farmers, Women groups, Asha Workers, Anganwadi Workers, Self Help Groups, Employees of Organization, Skill Development Trainees etc., This programme is conducted in line with the targets of National Strategy for Financial Education and the focus have been given to Special Focused Districts (SFDs). This programme expects to substantially contribute to NCFE’s vision of a “Financially aware and empowered India”.

Financial Education Training Program (FETP)

FETP is an initiative of the NCFE for providing unbiased personal financial education to people and organizations for improving financial literacy in the country. NCFE has been conducting FETP for school-teachers, who are teaching students in classes 6 to 10 across India. The program, based on two pillars; education and awareness, aims to establish a sustainable financial literacy campaign that can empower people’s lives. After completion of the training, these teachers would be certified as ‘Money Smart Teachers’ and would facilitate the conduct of financial education classes in schools and encourage students to obtain basic financial skills.

Financial Awareness and Consumer

Training (FACT)

Globally, youth are becoming financial consumers earlier in their lives than ever before and making financial decisions (credit cards, education loans) that can have lasting consequences, if not well managed.

Money Smart School Program (MSSP)

This is an initiative of the NCFE to provide unbiased financial education in schools for improving financial literacy which is an important life skill for the holistic development of each student. The program is based on two pillars; education and awareness and aims to establish a sustainable financial literacy campaign that will empower an entire generation.

National Financial Literacy Assessment Test

Financial literacy is a core life skill that focuses on knowledge, behaviour and attitude required to make responsible money management decisions. In 2005, the OECD recommended that financial education start as early as possible and be taught in schools.

Financial literacy is a core life skill that focuses on knowledge, behavior and attitude required to make responsible money management

decisions. In 2005, the OECD recommended that financial education start as early as possible and be taught in schools.

Start Learning Free

E-Learning Management System

The E-learning Course is offered free of charge to all the registered users. This course will give users a solid knowledge base on disseminating financial literacy, which helps to address demand-side barriers as this makes customers informed and enables better financial decision making and ultimately financial wellbeing.

Start Learning Free

E-Learning Management System

The E-learning Course is offered free of charge to all the registered users. This course will give users a solid knowledge base on disseminating financial literacy, which helps to address demand-side barriers as this makes customers informed and enables better financial decision making and ultimately financial wellbeing.

Blogs

IMPACT OF FINANCIAL LITERACY ON SOCIETY

Types of Accounts involved while investing in stocks/shares

Anytime, anywhere documents in our hands from safe hands! Digilocker

FINANCIAL PLANNING FOR RETIRED PERSONS

MAHILA SAMMAN SAVINGS CERTIFICATE

Where There Is A Will, There Is A Way

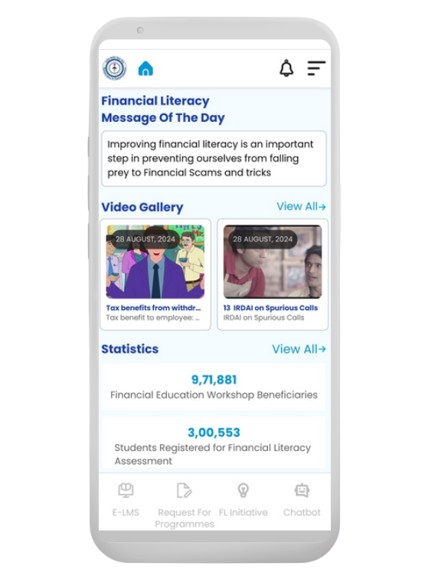

Dashboard

FEPA

FACT

MSSP

FETP

NFLAT

E-LMS

FEPA

To create financial awareness which will generate confidence in the financially excluded sections of the society to use the financial services and products more effectively thereby bringing more people to the formal financial sector

FACT

A program specifically designed to provide financial education to young graduates and postgraduates. This program covers topics relevant to this demographic, aiming to positively impact their financial well-being.

MSSP

The foremost benefit for schools implementing the Money Smart School program is that their students after becoming financially literate will be better equipped to deal with today’s complex financial products and services and exhibit prudent behaviour and attitude when it comes to managing their own money.

FETP

FETP is specifically designed for school teachers handling classes 6 to 10 throughout India. The program is built on two foundational pillars: education and awareness, intending to establish a sustainable financial literacy campaign that can positively impact people’s lives.

NFLAT

Financial literacy is a core life skill that focuses on knowledge, behaviour and attitude required to make responsible money management decisions.

E-LMS

This course will give users a solid knowledge base on disseminating financial literacy, which helps to address demand-side barriers as this makes customers informed and enables better financial decision making and ultimately financial wellbeing.

Blogs

IMPACT OF FINANCIAL LITERACY ON SOCIETY

Types of Accounts involved while investing in stocks/shares

Anytime, anywhere documents in our hands from safe hands! Digilocker

FINANCIAL PLANNING FOR RETIRED PERSONS

MAHILA SAMMAN SAVINGS CERTIFICATE

Where There Is A Will, There Is A Way

MISSELLING

Financial Wellbeing

Financial Education Is Our Greatest Asset

WHY BUY LIFE INSURANCE

The National Centre for Financial Education (NCFE) intends to publish an Expression of Interest (EoI) for Print and Digital Media Services on NCFE Website date 6 feb, 2025.

The National Centre for Financial Education (NCFE) is seeking to expand its outreach and further its mission of creating “A Financially Aware and Empowered India.” To this end, NCFE is inviting applications for the empanelment of individuals as Financial Education Trainers (FETs). Empanelled trainers are intended for conducting NCFE’s financial education programmes in accordance with […]

A joint initiative of the Department of Financial Services (DFS) and the National Bank for Agriculture and Rural Development (NABARD), this event celebrates Rural India – the soul of India. Hosted at the Bharat Mandapam in New Delhi from January 4 to 9, 2025, it will bring together government officials, thought leaders, rural entrepreneurs, and […]

Addendum to the Expression of Interest (EoI) for the Design, Development, Implementation, and Maintenance of a Learning Management System (LMS) for NCFE (Document Reference Number: NCFE/2024-25/EoI/02)

In line with the vision of achieving ‘Insurance for All by 2047,’ and in order to create more awareness on insurance products, the Insurance Regulatory and Development Authority of India (IRDAI) is organizing a Pan-India Insurance awareness quiz – BimaGyaan, on MyGov platform.

hide

- Publishing Date:

Last Date for Submission: April 23, 2025

hide

- Publishing Date:

Last Date for Submission: April 23, 2025

hide

- Publishing Date:

Last Date for Submission: March 13, 2025

hide

- Publishing Date:

Last Date for Submission: March 13, 2025

hide

- Publishing Date:

Last Date for Submission: February 17, 2025

hide

- Publishing Date:

Last Date for Submission: March 13, 2025

hide

- Publishing Date:

Last Date for Submission: February 10, 2025

hide

- Publishing Date:

Last Date for Submission: February 10, 2025

hide

- Publishing Date:

Last Date for Submission: December 31, 2024

hide

- Publishing Date:

Last Date for Submission: December 31, 2024

hide

- Publishing Date:

Last Date for Submission: August 27, 2024

hide

- Publishing Date:

Last Date for Submission: August 12, 2024

I have very sincerely attended Financial Education Program on 25/09/2021 and conducted by NCFE and very carefully listened advices of the Resource person since the begenning of session till the end. The impact of FE Program conducted by NCFE is very immense & cannot be measured & I take pride in saying that I have […]

I took part in a financial education workshop organized recently by NCFE, it had helped me & my family to come out from financial distress. I have learnt importance of budgeting, savings and planned investment. Earlier I had one cow giving 5-6 liter milk per day. Now I have purchased 2 more cows giving 15-20 […]

I Nikhil Sushil, living in Palappuram, a small village of Palakkad District, Kerala, is a student of Laksmi Narayana Arts and Science college Mayannur – Kerla. He has undergone NCFE’s Financial Education programme which helped him to understand the necessity of opening a saving account and need to save money for future Needs. I personally […]

Hello there, I’m Sanjeevi R. a student from KIT – Kalaighnarkar Karunanidhi Institute of Technology, Coimbatore. I learned from NCFE program the importance of investments and savings for future. I also realised my family members and I must be insured to Financially protect ourselve against any unforeseen event. Before this workshop I had no idea […]

Chetna Kumre is resident of Sitatola village. This village has sent percent primitive tribes (Madia-gond) population. Chetna Kumre is Chairperson of Mahavaishavi Mahila Bachat Gat in the village itself. She runs a small grocery shop at the porch of her small house. There is village around Sitatola. At the distance of 2 Km is the […]

Nikki is a young woman from Bahedeki, a remote village in Saharanpur district’s Baliakheri Block in Uttar Pradesh. She took part in a financial education workshop organised recently by National Centre for Financial Education (NCFE), which was, in her own words, a life-changing experience. “I learned the importance of budgeting, savings and planned investment. I […]

Thanks to NCFE, National Centre for Financial Education Mumbai for conducting teacher’s training programme at our Stree Sudhan Girls Inter College Bareilly. It has really been an unprecedented Financial Education Program never done before consequent upon which , I was so motivated and felt that I should spread the same content to my girls students […]

Mathura Harijan, is a school teacher who stays in Nandahandi Block of Nabarangpur District, Odisha. He attended the financial education workshop conducted by NCFE resource person. The programme was specially conducted in local language so as to make the local tribal people understand more about financial education and government schemes in financial sector. After attending […]

It is said “You only become strong when you don’t have a choice”. Here is how Nitaben Makwana had an experience of the same. Nitaben, a regular housewife looking after daily household chores and taking care of kids. Her husband was working in a company at Dubai and life was all good for a typical […]