About NFLAT

Financial literacy is a core life skill that focuses on knowledge, behaviour and attitude required to make responsible money management decisions. In 2005, the OECD recommended that financial education start as early as possible and be taught in schools.

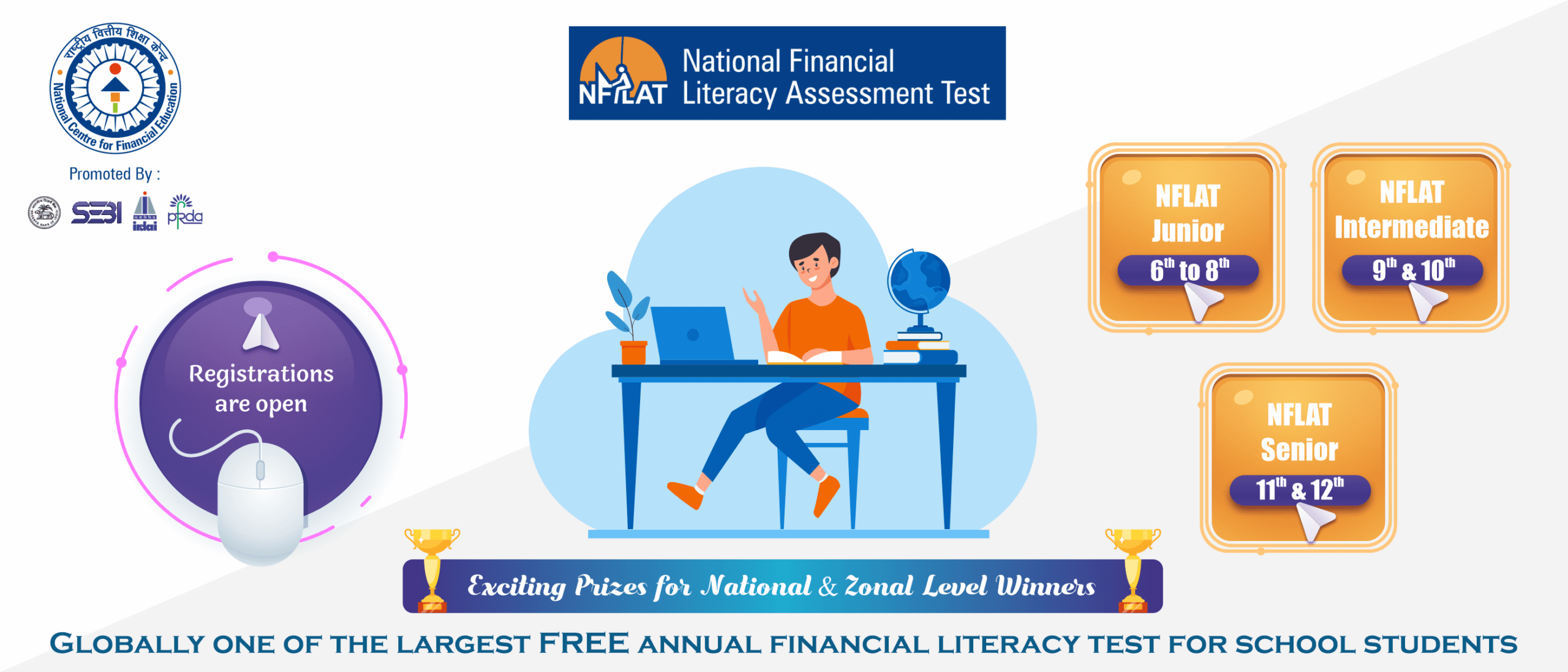

In line with OECD recommendation, National Financial Literacy Assessment Test (NFLAT) conducted by the NCFE, encourages school students of Class VI to XII, to acquire basic financial skills necessary to make informed and effective financial decisions throughout each stage of their lives.

NFLAT was launched in the year 2013-14. Globally, it is one of the largest FREE annual financial literacy test for school students.

Why NFLAT?

Students who are financially literate are better equipped to make informed financial decisions, such as how to save and spend their money, how to invest their money, and how to borrow money. This is important because it can help them avoid financial problems in the future. Financial scams are on the rise, and students need to be aware of them in order to protect themselves. Financial literacy can help students learn how to identify and avoid financial scams.

When students know that they will be assessed on their financial knowledge, they are more likely to take the time to learn the concepts and through an assessment test, it encourages students to take the time to learn about financial concepts and develop the skills they need to make informed financial decisions.

In line with OECD recommendation, National Financial Literacy Assessment Test (NFLAT) conducted by the NCFE, encourages school students of Class VI to XII, to acquire basic financial skills necessary to make informed and effective financial decisions throughout each stage of their lives. The questions generally cover the basic concept of Banking, Securities Markets, Insurance and Pension.

In this regard, we would request you to encourage participation among students. The Financially literate students can educate others about financial literacy, such as their family, friends, and classmates. This can help to improve the overall financial literacy of the nation.

Rewards and Recognition

To encourage students for obtaining basic financial skills, each participating student is awarded an e-certificate, based on their performance.

The certificate will be of three types

1. Participation – For all participated student

2. Merit – Student who scores above 50% of the total marks

3. Outstanding – Student who scores above 85%

e-gift cards would be given to Winners in both National and Zonal level

Note: A certificate of Appreciation would also be given to the school coordinator

Important Dates

Registration is open

| Particulars | Start Date | End Date |

|---|---|---|

| School Registration | 02nd December 2024 | 28th May 2025 |

| Student Registration | 02nd December 2024 | 29th May 2025 |

| Examination | 01st January 2025 | 31th May 2025 |

Test Categories

The test is open for school students of Class VI to XII in 3 separate categories:

1. NFLAT Junior

- For Class 6 to 8 students.

- Language: English.

- Mode: Only in online (computer based) mode.

2. NFLAT Intermediate

- For Class 9 and 10 students.

- Language: English.

- Mode: Only in online (computer based) mode .

3. NFLAT Senior

- For Class 11 and 12 students.

- Language: English.

- Mode: Only in online (computer based) mode .

Information for Schools

NFLAT 2024-25 Registration is open now

Limited seats only. Participation is on a first-come, first-serve basis.

Online Test (computer based)

The test is available on Monday to Friday (excluding holidays) between 10:00 am to 5:00 pm.

Schools having a computer lab with internet connectivity can conduct the test in their premises. As well as School can allow student to take from his home, provided the availability of PC/ Laptop

Test Syllabus

For all the 3 categories of the test (NFLAT Jr, NFLAT Intermediate and NFLAT Sr) the syllabus will remain the same. However, the degree of difficulty will vary according the Class. The test syllabus covers the following modules:

- Money Matters – Income, Expenditure and Budgeting

- Banking – Deposits, Credit and Payments

- Insurance – Risk and Reward

- Investment – Stocks, Bonds and Mutual Funds

- Pension – Retirement Planning

- Financial Inclusion – Government Schemes

- Taxation – Income Tax and GST

- Consumer Protection – Scams, Frauds and Role of Regulators

How to Register and Enroll for the Test

Direct registration by the students is not allowed. For participating in the test, the student must approach his/her school.

Currently, registration is available only for those schools who want to conduct the Online Test (computer based) in their premises.

The registration and enrolment process involves the following 3 steps:

1. School Registration:

In the first step the school needs to register itself for NFLAT 2024-25. Once the registration is complete, the school will receive a ‘User ID’ and ‘Password’. Registration is closed.

2. Student Registration:

in the second step, using the received ‘User ID’ and ‘Password’ , the school needs to upload the details of students interested to participate in the test. This completes the registration process. Registration is closed

3. Take the Test:

Once a student has been enroled for a particular ‘Date and Time’, the school must ensure that he/she appears for the test using the given ‘User ID’ and ‘Password’.

More details about the registration process are available on the registration page. Schools are advised to read all the instructions, carefully. In case if you need more clarification or if you have any queries, please call us at 022-68265123/124 or write to us at nflat@ncfe.org.in

Reference Study Materials for the Test

Given below are a list of downloadable study materials which may help the students prepare for the test. Students are encouraged to go through other study materials available in our website (https://ncfe.org.in) or any from other source. We also advise students to watch our Financial Education Video Series

- Pocket Money Workbook – English | Hindi

- Financial Education for School Children – English | Hindi

- Introduction to Retirement Planning by PFRDA – English

- Personal Finance for School Students by NCERT – English

- Basics of Banking by RBI – English

- Introduction to Insurance by IRDAI – English

- Basics of Goods and Services Tax by CBIC – English

- Capacity Building for Financial Literacy Programmes by RBI – English