40℅ EMI Rule

Never go beyond 40℅ of your income into EMIs.

If one’s earnings are Rs. 50,000 per month, he/she should not have EMIs more than Rs. 20,000.

This Rule is generally used by Finance companies to provide loans. This can be used to manage one’s personal finances.

100 minus your age rule

This rule is used for asset allocation. One can find out how much of his/her portfolio to be allocated to equities by subtracting one’s age from 100. This can be as per the below

Age 30 Equity : 40% Debt : 60% | Age 60 Equity : 70% Debt : 30% |

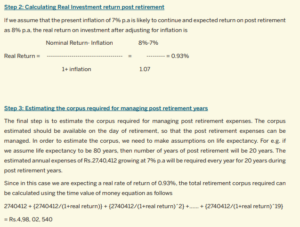

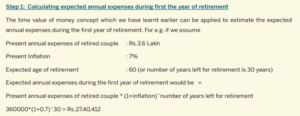

How much money you need to make when you retire? (Page 31,32 of CABFLiP)