NCFE

|

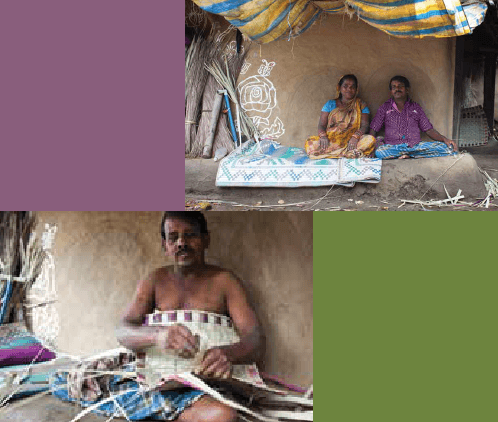

Mr Umesh Behera, used to earn money to support his family by picking coconuts from trees in his home village in Odisha. One day, 20 years ago, he broke his back after he fell from a tree while doing his job. The accident rendered him paraplegic and he was not able to work in his job anymore. The family lost their only stable income and did not have any emergency savings or even insurance cover to manage this new situation. In addition, medical expenses had to be borne by the family over the following years. Many years later, Umesh received a loan from a local NGO which gave him the opportunity to lease around 100 coconut trees for INR 8,000 per year. He hired a picker to harvest the ripe coconuts from the leased trees and now sells these coconuts at the nearby market and hospital using his wheelchair as a mobile selling counter. Together with his wife, he generates additional income by producing and selling mats, baskets, fans and brooms made of the palm leaves of the leased coconut trees. The financial situation of the family is still very difficult. However, it has slightly improved compared to the past. With a monthly income of around INR 4,500, recurrent medical expenses are a particular burden for the family.

Courtsey: GIZ-NABARD Rural Financial Institutions Programme Source: http://www.giz.de/en/worldwide/16012.html |

|